year end accounts date

Be split across six discounts between October. The year end date will be the end of the month in which the company was set up.

How To Determine A Corporation S Fiscal Year End Date

The rules on changing your financial year end.

. At the end of a companys fiscal year all temporary accounts should be closed. The balance of the main account can be transferred to a new main account during the year-end close. It cant be longer than 12 months and is normally the same as the financial year covered by your.

Its normally the same 12 months as the company financial year covered by your annual accounts. The term year end refers to the date on which. Temporary accounts accumulate balances for a single fiscal year and are then emptied.

The first accounting year end date for a new company is the last day of the month in which the first anniversary falls on. Other than the retained earnings account closing journal entries do not affect permanent accounts. It is also known as an accounting reference date for limited companies.

These include reporting and data processing deadlines and the fiscal close. The one thing you cant do after a year is closed is change the account date periods. The year end of the limited company will have been set by Companies House when the company was formed.

15 hours agoMajor change to energy bills as end date set for 2500 freeze. Prepare a closing schedule. This is when you close your.

Your accounting period for Corporation Tax is the time covered by your Company Tax Return. For an unincorporated business profits for the year are decided. Examples of Central Office accruals are utility bill accruals that span.

These accruals are recorded by certain offices such as Facilities Dining and OIT at year end during 1st and 2nd close. Worth up to 1399 hitting bank accounts before Xmas. Means the audited balance sheets as at the Year-end Accounts Date and audited profit and loss accounts and the audited cash flow statements for the year ended.

The date by which the companys accounting period is going to end is known as the Year end of a Company. The goal of the year-end closing process for accounting is to issue financial statements at the close of the fiscal year. Year-end refers to the end of your companys accounting period.

Also you must send detailed information and company accounts to Companies House annually within nine months of your companys year-end accounting period. It also includes the same date when. For example if your company was incorporated on 15 January 2021.

21 months after the date you registered with Companies House. Identify the important dates and the activities that must be completed by each. Have a look under calendar setup on the Navigate tab and check you are happy with.

The record is marked as Reversed and stamped with the date and time. Vintage must issue financials for the 123121 year end which is the. Year End in Accounting.

You can shorten your companys financial year as many times as you like - the minimum period you can shorten it by is 1 day. This has to be submitted. If your company is incorporated a financial year end date will determine when payment of tax falls due.

At the end of your.

.png)

Worked Example Of A Business That Has Changed Its Accounting Year End Basis Periods Knowledge Base

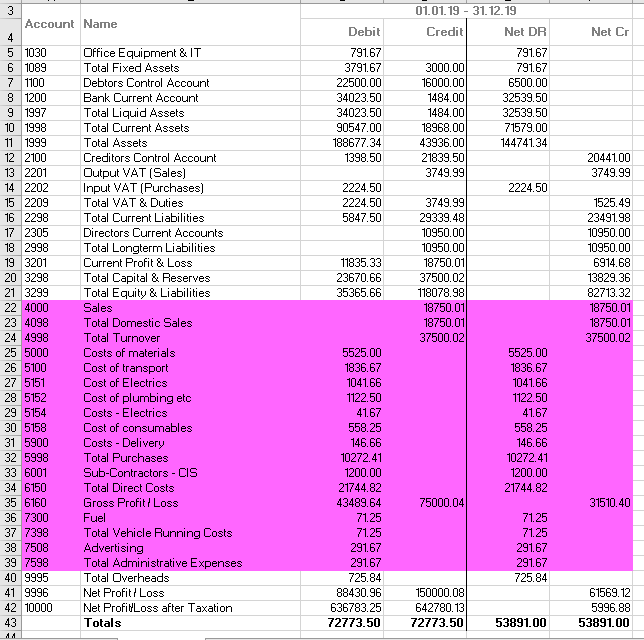

Year End Close Balance Sheet And Profit Loss

10 End Of Year Bookkeeping Tips

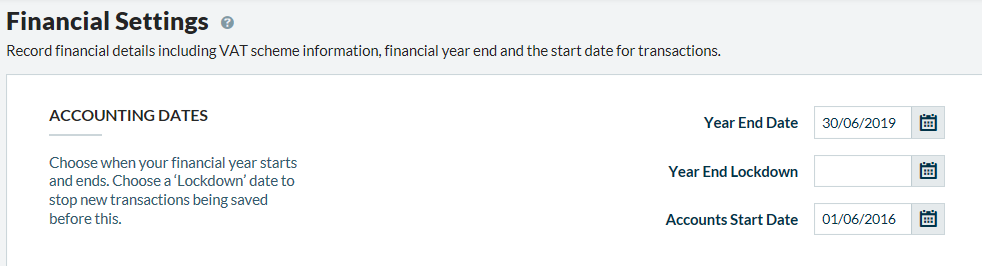

Accounting Periods And Year End Brightpearl Help Center

How To Complete Your Limited Company S Year End Accounts

Abc Of Accounting The Year End Closing Entries

Quickbooks Year End Questions And Answers For Quickbooks Desktop

How To Use The New Up To Period Filter In Sage Intelligence For Accounting

Solved How Do I Close Out End Of Year

Fiscal Year Explained How To Choose One For Your Business Bench Accounting

Accounts Payable Fiscal Year End Close A 10 Step Checklist Tradeshift

How To Check The Year End Of Your Limited Company Goselfemployed Co

Expert Answer Warner Company S Year End Unadjusted Trial Balance Shows Accounts Receivable Of Brainly Com

Solved At Year End December 31 2020 Corolla Sales Showed Unadjusted Balances Of 396 000 In Accounts Receivable 14 200 Debit In Allowance For Course Hero

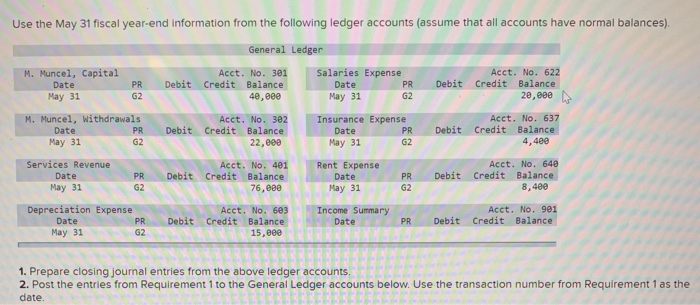

Solved Use The May 31 Fiscal Year End Information From The Chegg Com

Must Have Year End Checklist For Small Business Bookkeeping Shockley Tax Services Bookkeeping